For nearly 50 years, Fidelity United has stood as a pillar of excellence in the UAE’s insurance sector. Founded in 1976, this industry leader is now expanding its team and seeking dynamic professionals to fill four critical roles. If you’re passionate about risk management, finance, or audit within the insurance landscape, your next career move starts here.

| Details | Relevant Information |

|---|---|

| Company | Fidelity United |

| Job Location | UAE |

| Category | |

| Qualification | Degree/Diploma or Equivalent |

| Experience | Mandatory |

| Salary | Attractive Salary Package |

| Benefits | As Per UAE Labour Law |

| Nationality | Selective |

| Last update | 06/08/2025 |

🔍 Why Join Fidelity United?

- Legacy of Trust: A reputable player since 1976 with deep industry roots.

- Regulatory Expertise: Focus on UAE Central Bank (CBUAE) compliance and international standards like IFRS 17.

- Growth Culture: Emphasis on proactive risk awareness and continuous improvement.

💼 Current Openings (2025)

1. Risk Manager

Lead the defense against financial uncertainties

Core Responsibilities:

- Develop company-wide risk frameworks and mitigation strategies.

- Monitor CBUAE compliance (capital adequacy, liquidity, solvency).

- Conduct stress tests and manage Own Risk & Solvency Assessments (ORSA).

- Track Key Risk Indicators (KRIs) and report exposures to the Board.

Qualifications & Skills:

- Bachelor’s/Master’s in Risk Management/Finance + FRM/PRM certification.

- 5–7 years’ insurance risk experience.

- Mastery of risk assessment tools and UAE regulatory norms.

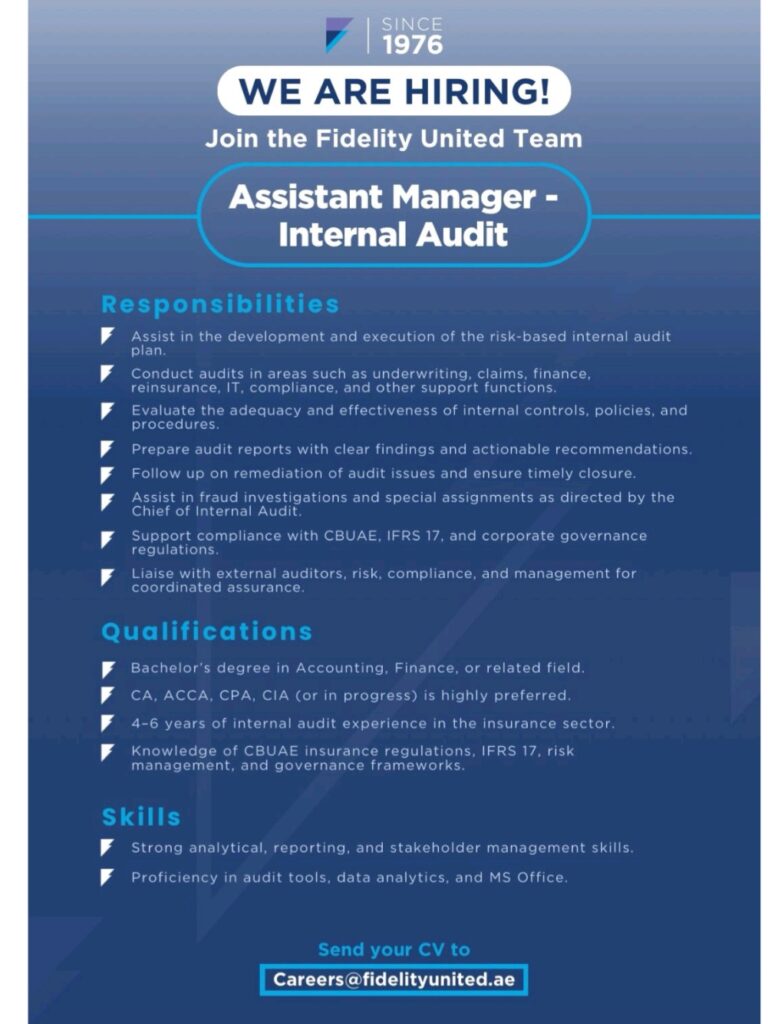

2. Assistant Manager – Internal Audit

Guardian of governance and controls

Core Responsibilities:

- Execute audits across underwriting, claims, finance, IT, and compliance.

- Evaluate controls and draft actionable audit reports.

- Support fraud investigations and CBUAE/IFRS 17 compliance.

Qualifications & Skills:

- Bachelor’s in Accounting/Finance + CA/ACCA/CIA.

- 4–6 years’ insurance audit experience.

- Proficiency in data analytics and stakeholder management.

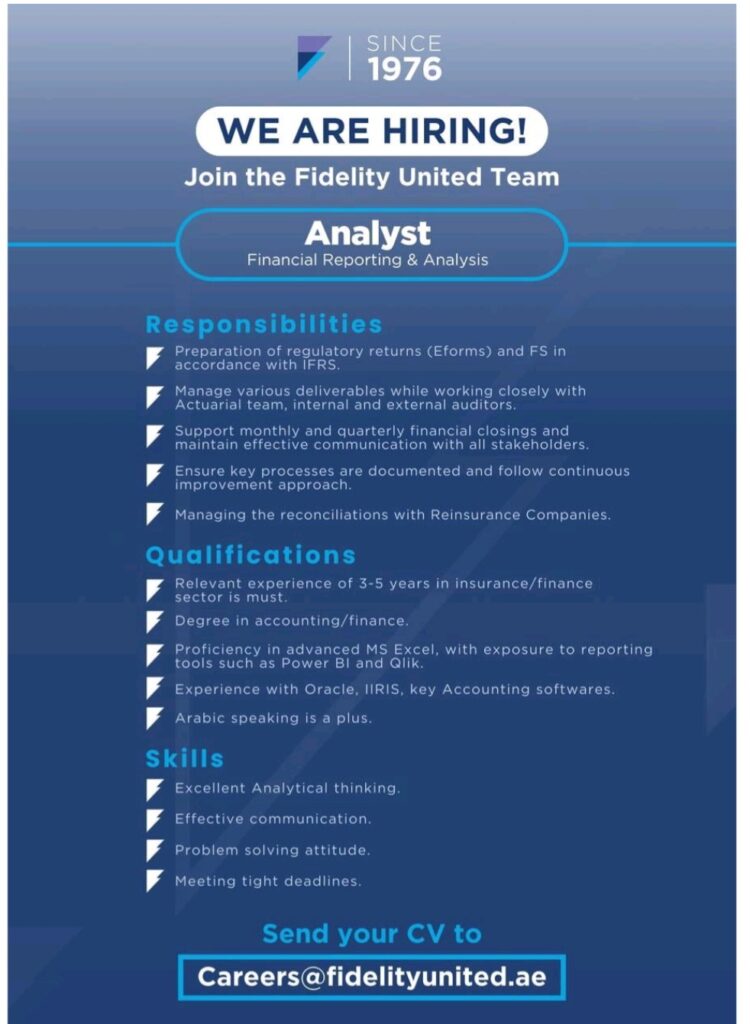

3. Analyst – Financial Reporting & Analysis

Precision in numbers, clarity in insights

Core Responsibilities:

- Prepare IFRS-compliant financial statements and regulatory returns.

- Manage reinsurance reconciliations and monthly/quarterly closings.

- Collaborate with actuarial teams and auditors.

Qualifications & Skills:

- Degree in Accounting/Finance + 3–5 years’ insurance/finance experience.

- Advanced Excel/Power BI skills + Oracle/IRIS software knowledge.

- Arabic fluency (advantage).

4. Collections Executive

Cash flow catalyst and relationship expert

Core Responsibilities:

- Reconcile insurer accounts, track aging reports, and recover overdue balances.

- Manage broker commissions and premium collections.

- Escalate delays and propose provisions for bad debts.

Qualifications & Skills:

- Degree in Accounting/Finance + 3–5 years’ insurance collections experience.

- Oracle/IRIS proficiency + conflict-resolution skills.

- Arabic fluency (advantage).

📝 How to Apply

Process:

- Prepare Your CV: Highlight role-specific experience (e.g., IFRS 17 for Analysts, ORSA for Risk Managers).

- Email Submission: Send to Careers@fidelityunited.ae with the job title as the subject line.

- Deadlines: Roles close between May–August 2025 (check job ads for exact dates).

Essential Documents:

- Updated CV (PDF format).

- Relevant certifications (FRM, CPA, ACCA, etc.).

- Cover letter (optional but recommended).

🎯 Eligibility Snapshot

| Role | Experience | Education | Certifications |

|---|---|---|---|

| Risk Manager | 5–7 years | Bachelor’s/Master’s | FRM/PRM preferred |

| Asst. Audit Manager | 4–6 years | Bachelor’s | CA/ACCA/CIA required |

| Financial Analyst | 3–5 years | Finance Degree | — |

| Collections Executive | 3–5 years | Finance Degree | — |

❓ FAQs

Q1: Is Arabic mandatory for all roles?

No, but it’s a plus for client-facing positions (Collections Executive, Analyst).

Q2: Does Fidelity United sponsor work visas?

Yes – all roles are UAE-based with visa sponsorship.

Q3: Are remote/hybrid options available?

Roles are primarily on-site due to regulatory collaboration needs.

Q4: How soon can I expect a response post-application?

Shortlisted candidates are contacted within 2–3 weeks.

Q5: What growth paths exist post-hiring?

Leadership tracks include Senior Manager, Head of Department, and regulatory specialization.

🚀 Take the Leap!

Fidelity United merges legacy with innovation – a place where your skills fuel tangible impact. With roles spanning risk, audit, finance, and collections, your expertise will shape the future of UAE insurance.

👉 Ready to apply? Email your CV to Careers@fidelityunited.ae today!

“Join a team where integrity meets opportunity – since 1976.” – Fidelity United

🔁 Repost this to empower job seekers! | 💬 Questions? Comment below!

Disclaimer: Job details sourced from official Fidelity United posts. Verify deadlines via careers@fidelityunited.ae.

Disclaimer

📌 Rozgarlive.in is a completely free and open-source job platform dedicated to providing continuous updates on the latest job opportunities in Gulf countries for job seekers.

Note:

📌 Rozgarlive.in is not a recruitment agency, visa service, or job consultancy.

📌 We do not endorse or support any payment requests and strongly advise against sharing personal or banking details with anyone.

📌 Rozgarlive.in is not responsible for the recruitment process. Candidates are solely responsible for their agreements and terms with employers during the hiring process.

Leave a Comment